Blog

Blog

By Appfolio Websites

•

15 Dec, 2014

The U.S. Census Bureau recently reported that Austin is among the three fastest-growing cities in the country, and seventh for number of residents increased between 2012-2013. Dynamic in so many ways—business and technology growth, area colleges and universities, world-famous music festivals, popular athletic events, year-round recreational activities, eco-friendly advances, diverse night life, and more—it’s no surprise that growth all around Austin is booming, especially in the Cedar Park and Leander areas. The data on these two cities is exciting. Of cities with at least 50,000 residents, the Census Bureau rates Cedar Park as the 4th fastest growing in the U.S., with a 5.6% population increase. Bursting with growth, its present population of over 61,000 grew 18.4% between 2010-2013, and an amazing 90.14% since 2000. Averaging an unemployment rate under 4%, a low rental vacancy rate, appreciating property values, and newly completed business developments, Cedar Park is a great city to live and invest. Leander is another desirable city in the Austin Metro area. In September the Leander and Cedar Park city councils both passed tax rates which will lower homeowners’ property tax rates for 2014-2015. According to the Bureau of Labor Statistics, Leander’s unemployment rate so far this year is 3.40%, the 4th lowest in Texas. Earlier this year the Austin Business Journal called Leander “ground zero for growth,” which isn’t surprising since it had a 20.6% population growth between 2010-2013, and an astounding 105.34% increase since 2000. Last December, The Milken Institute’s annual index of Best-Performing Cities announced Austin as the best-performing metro area in the U.S., weighing employment growth most heavily because of its primary importance to a city’s vitality. The Austin Metro is an exceptional place to work and a vibrant place to live, and because Austin is one of the fastest-growing U.S. cities, home values continue to increase, yet mortgage interest rates remain low. This makes Cedar Park and Leander great places to find a home—or even to become a landlord! Whether you want to purchase a home or an investment property, or even refinance an existing property, call us at 512-257-9836 for a free market or lease analysis, and to answer any questions you may have. Our office provides sales, leasing, property management, and mortgage services. You can also visit our website at www.smartsourcerealty.com .

By Appfolio Websites

•

03 Dec, 2014

Millennials play a large role in Austin’s rental market. Born between 1982-2000, Millennials comprise 25% of our city’s population. They are the fastest-growing workforce population in Austin, and 90% of them rent! According to a recent article in The Austin American-Statesman, Millennials save at a far lower rate than the last three generations. Most of them are not saving at all and have little or no assets. This means that renting is more affordable to them and may be their only option. Millennials are more willing to move and change jobs. Renting gives them the flexibility they desire. So what do Millennials look for when renting a home? Over half of Millennials enjoy cooking. They want a new, modern kitchen. They eat out less and really like an outdoor living space for entertaining friends. This is even more important to those with children. They love their pets–most of them have at least one dog or cat. They want places to ride their bikes (and bike storage) or walk their pets, and many like to be within walking or biking distance to a store, restaurant, café, trail or park. Connectivity! Millennials are incredibly tech-savvy and most of them have smart phones–and they’re constantly connected. Most pay all bills online, and they love to make purchases on modern-looking, mobile-friendly websites. In fact, over half of Millennials report that if they have difficulty searching a site with their smart phone, they probably won’t use that company or business. Because Millennials are the online self-service generation, our company has gone to great lengths to makes sure that potential and current clients can not only apply online, pay their application fees and their rent online, but can create their work-orders online. They communicate with us online, too, whether they have questions or are in need of repairs. Our property management system will even send text messages to tenants. They don’ want us to call them. So, we make it easy to do business with Millennials. Austin is a beautiful, active, high-technology, ever-growing dynamic city which consistently rates in the top 5 “Best Cities” among 25-to-34 year-old Millennials. For them, Austin is great place to live, and while mortgage interest rates are still low, this also makes Austin the perfect place to be a landlord. Whether you are looking into purchasing an investment property or want to refinance an existing property, feel free to call us for a lease analysis or to answer any questions you may have. Our office provides sales, leasing, property management, and mortgage services. You can also visit our website at www.smartsourcerealty.com

By Appfolio Websites

•

17 Nov, 2014

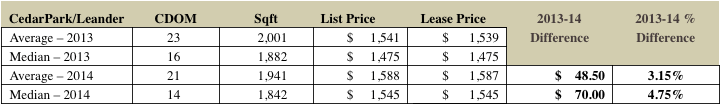

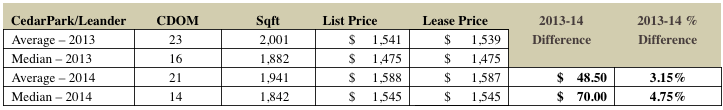

It is a great time to be a landlord and have investment property in Austin and surrounding area. As many of you know, rents took a dive with the high tech bust in early 2000’s. Finally, fourteen years later, rents are at an all-time high. Austin continues to grow, and over 100 people are moving to the area daily. Since we manage many homes in the Cedar Park/Leander and Round Rock area, we did a lease analysis for these areas. We did a year-to-date rent analysis for 2014 and compared to 2013 using MLS leasing data. We analyzed average and median rents. Below is a chart showing leasing data for the Cedar Park/Leander area for single-family homes:

By Appfolio Websites

•

17 Nov, 2014

It is a great time to be a landlord and have investment property in Austin and surrounding area. As many of you know, rents took a dive with the high tech bust in early 2000’s. Finally, fourteen years later, rents are at an all-time high. Austin continues to grow, and over 100 people are moving to the area daily. Since we manage many homes in the Cedar Park/Leander and Round Rock area, we did a lease analysis for these areas. We did a year-to-date rent analysis for 2014 and compared to 2013 using MLS leasing data. We analyzed average and median rents. Below is a chart showing leasing data for the Cedar Park/Leander area for single-family homes:

By Appfolio Websites

•

15 Jun, 2013

Our company manages over 300 properties. We always try and work things out with tenants when there is a problem paying rent. Our yearly eviction is very low (less than 2%), and we only file when tenants are not able to pay rent and have no source of income. Eviction is always a lose-lose scenario for both landlord and tenant. We recently received an eviction judgment for a tenant for non payment of rent in Justice of the Peace court. The tenants moved into home after paying their security deposit through our ACH system, and their first month’s rent draft was returned NSF. While we have many issues with tenants paying rent in a timely manner, this was the first time we evicted a tenant for not paying the first month’s rent. Their rent draft bounced in the online tenant portal. Tenant did not respond to email correspondence or calls, so we filed the eviction. The judge awarded a judgment for possession and amount of past due rent. Once the landlord receives a judgment, the tenant has five days to either vacate property or file an appeal. If an appeal is not filed and tenants fail to vacate within five days, we file a writ of possession. This allows the constable to place a notice on the door, and we remove the tenant’s personal items and place them on the curb. The tenants filed an appeal as a pauper on day five. This allows them to appeal the case without a bond. Usually a bond is required, but this is waived if tenant file as a pauper. However, the tenants are required to pay one month’s rent into the court registry within five days of filing the appeal. Most don’t pay into the court registry. This allows them to buy more time and get five more days to live in home before a writ of possession can be issued. Surprisingly, the tenants did pay the first month’s rent into the court registry. Once they do, the Justice of The Peace court forwards the file to the county court. The tenants are required to pay additional monthly rents until a hearing is held. We were surprised the tenants paid the first month’s rent, because these funds will be surrendered to the landlord if landlord receives judgment in county court. Most file the appeal and don’t pay the rent into court registry. Once file goes to county court, we cannot represent the landlord as the property manager. An attorney must be hired, or the landlord must file all motions and judgment paperwork pro se. The county court does not file any paperwork. This is why the landlord should hire an attorney. In JP court, the judge will prepare and sign the judgment. This is not the case in county court. Our client filed the paper work pro se without hiring an attorney. We did however assist the landlord in presenting the case to the judge. The tenant failed to pay the two most recent month’s rent to the court registry and breached the appeal rules by not paying the additional rents when due. The hearing lasted only a few minutes. Unless there is a legal reason to not pay rent, the landlord will usually prevail in court and receive the judgment as long as paperwork is filed properly. The judge awarded the landlord a judgment for two month’s rent plus a reletting fee for breach of lease. Additionally, the judge agreed to release the first month’s rent received in court registry to the landlord and agreed to sign a writ of possession within three days. In summary, it can be very challenging in dealing with the eviction process. Most landlords don’t understand the rules and requirements. Hiring a property manager can help you deal with these issues in the event an eviction is needed. If you have any questions, please call us at 512-257-9836. Our office provides sales, leasing, property management, and mortgage services

Smart Source Realty

(512) 257-8207

1001 Cypress Creek Rd, Cedar Park, TX 78613, United States

Locations

Cedar Park

Round Rock

Leander

Austin